In the world of insurance, you’ll come across various ACORD forms, each with a specific role. ACORD 126, in particular, stands out as a significant contributor.

ACORD 126 helps you communicate your business’s details clearly and accurately to the insurance company. On the flip side, insurance professionals use ACORD 126 to assess risks and determine the right coverage for you.

So, when we talk about ACORD 126, we’re talking about improved communication, accuracy, and finding the insurance that truly works for you.

Let’s take a closer look at what ACORD 126 is all about and why it matters.

What is ACORD 126?

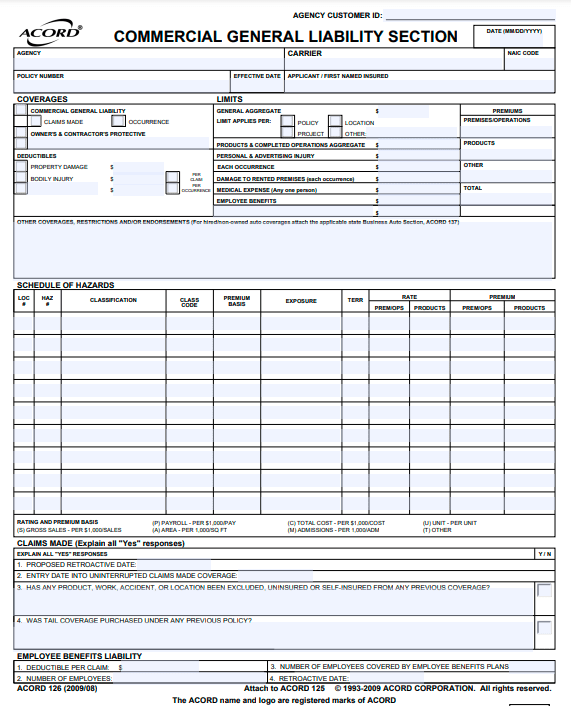

ACORD 126, or the Commercial General Liability Section, is a pivotal insurance document that fosters clear communication between insurers and clients. This clarity extends to transactions, terms, and crucial policy details.

ACORD 126 leverages automated processing to handle client info, exposure assessment, loss history, and business operations details efficiently.

Who Utilises ACORD 126 and Why?

ACORD 126 is used by insurance agencies and brokers to insurance companies themselves. It simplifies communication of critical details during insurance applications, particularly those found in the Commercial General Liability Section. It expedites the underwriting process, benefiting organizations and clients seeking streamlined coverage.

What information does Acord 126 contain?

ACORD 126 acts as a comprehensive snapshot of the insurance policy, bringing together these critical pieces of information into a structured and organized format.

ACORD 126

Download ACORD 126 Form PDF fillable version here

This form contains a range of critical details that are crucial for both insurance professionals and clients seeking a comprehensive understanding of insurance transactions.

Here’s a breakdown of the specific information that ACORD 126 contains:

|

Acord 126 Details and Entries | |||

|

1. |

Policy Identification |

Policy number |

A unique identifier for the insurance policy. |

|

Effective date |

The date when the insurance coverage starts. | ||

|

2. |

Insured Details |

Insured’s Name |

The individual or entity being covered by the insurance policy. |

|

Contact information |

Address, phone number, and email of the insured. | ||

| 3. |

Coverage Information |

Types of coverage |

The specific types of risks and liabilities covered by the insurance policy. |

|

Coverage Limits |

The maximum amount the insurer will pay in the event of a claim. | ||

|

Deductibles |

The amount the insured needs to pay before the insurer covers the rest of the claim. | ||

|

4. |

Risk Assessment |

Insured’s exposure |

Detailed information about the potential risks and exposures faced by the insured. |

|

Loss history |

Past claims and losses experienced by the insured. | ||

|

5. |

Business Operations |

Description of operations |

An overview of the insured’s business activities. |

|

Locations |

Details about the physical locations where the insured conducts business. | ||

|

6. |

Additional Information |

Additional insured |

Any other parties or entities covered under the policy. |

|

Endorsements |

Any modifications or special provisions added to the policy. | ||

|

7. |

Commercial General Liability Section |

Liability coverage details |

Specifics of liability coverage, including bodily injury and property damage. |

|

Limits of liability |

The maximum amount the insurer will pay for different liability scenarios. | ||

By encompassing these details, the form facilitates clear communication and ensures that both insurers and clients have a comprehensive understanding of the insurance coverage and its implications.

Benefits of Using ACORD 126

Here are some of the key advantages that ACORD 126 brings to the table:

1. Standardised Format for Effortless Processing

One of the standout benefits of ACORD 126 is its standardized format. This consistent structure simplifies the processing of insurance applications for insurers.

With uniform sections dedicated to specific information categories, such as policy identification, coverage details, and risk assessment, insurers can navigate the form, extracting essential data without confusion.swiftly

2. Reduced Errors and Omissions

By providing clear fields for policy numbers, coverage limits, deductibles, and other critical information, ACORD 126 leaves minimal room for misinterpretation.

This minimization of mistakes ensures that insurance professionals and clients are working with accurate and reliable data, ultimately leading to improved decision-making.

3. Enhanced Efficiency in Information Exchange

ACORD 126 is designed with efficiency in mind. Its structured layout means that relevant details are logically organized, making it easier to locate and communicate critical information.

This efficiency extends beyond insurers to clients, streamlining the process of understanding policy specifics, coverage limits, and associated risks.

How to Complete ACORD 126?

ACORD 126 serves as a standardized template for sharing critical information.

Whether you’re an insurance professional or a client, understanding how to complete this form accurately is essential. Here’s a step-by-step guide to walk you through the process:

Download ACORD 126 Form PDF fillable version here

Step 1: Gather the Necessary Information

Before you start filling out ACORD 126, ensure that you have all the relevant information at your fingertips. This preparation will streamline the process and help you provide accurate and complete details:

- Policy details: Gather the policy number, effective date, and any endorsements or modifications that apply.

- Insured information: Collect the name, contact details, and other relevant information about the insured party.

- Coverage specifics: Have a clear understanding of the types of coverage required, coverage limits, and deductibles.

- Business operations: If applicable, compile information about the insured’s business activities and physical locations.

- Additional insured parties: Identify any parties that need to be listed as additional insured on the form.

Step 2: Complete the Form Accurately and Legibly

With the necessary information on hand, it’s time to complete ACORD 126 with accuracy and legibility.

- Use clear handwriting or type the information if possible. Legibility is crucial to avoid any misunderstandings.

- Enter information in the designated fields. The form’s structured layout makes it easy to identify where specific details should be provided.

- Double-check the information as you enter it. Accuracy is essential to ensure that the policy terms and coverage details are correctly reflected.

Step 3: Add Date and Sign the Form

Once you’ve accurately filled out ACORD 126, the final steps involve adding your signature and the date:

- The insured party or authorized representative should sign the form to certify its accuracy and completeness.

- Date the form to indicate when it was completed and signed.

Additional Tips for Completion of Acord 126:

- If you’re uncertain about any terms or sections of the form, don’t hesitate to seek guidance from an insurance professional or the insurer’s customer service.

- Consider making a copy of the completed form for your records before submitting it to the appropriate parties.

- Ensure that any required endorsements or modifications are clearly indicated and included in the form.

By following these steps and guidelines, you’ll be able to confidently complete ACORD 126, ensuring that the information shared is accurate, clear, and aligned with the insurance requirements.

Importance of ACORD 126

|

Importance of ACORD 126 |

Legal Liability Clarified |

Protection for Owners and Employees |

Resolution of Disputes and Filing Claims |

|

Policy Transparency |

Ensures clear understanding of policy terms and limits |

NA |

NA |

|

Compliance with Regulations |

Helps meet industry standards and legal requirements |

NA |

NA |

|

Comprehensive Coverage |

NA |

Safeguards business operations against potential liabilities and financial losses |

NA |

|

Employee Assurance |

NA |

Ensures a safe and transparent work environment for employees |

NA |

|

Evidence in Disputes |

NA |

NA |

Serves as evidence in conflicts and aids efficient claims processing |

|

Efficient Claims Processing |

NA |

NA |

Enables swift processing of claims by providing accurate details |

How to Automate Acord 126 Processing?

Insurance professionals and clients often want to automate ACORD 126 processing to streamline their operations, reduce manual efforts and enhance the overall insurance experience.

One such solution that paves the way for seamless ACORD 126 processing is KlearStack’s Document Automation Process.

1. Data Extraction: Scanning Acord 126 & extracting some fields like policy number, etc

KlearStack’s advanced AI and OCR technologies read and extract critical data from ACORD 126.

Consider this Acord 126 example: Imagine an insurance agent receiving a filled ACORD 126. KlearStack scans the form, capturing policy numbers, coverage specifics, and risk assessments automatically.

Manual data entry is eliminated, reducing the chances of errors and enhancing accuracy.

2. Data Verification: Matching the extracted data

The extracted data undergoes a thorough verification process. KlearStack cross-checks the extracted information against existing databases and records

Continuing with the Acord 126 example, KlearStack matches the extracted policy number with the insurer’s database, ensuring consistency and accuracy.

This verification step ensures the accuracy of the extracted data, reinforcing the reliability of the automated process.

3. Structured Data Output: Organising & integrating data with other systems

Once verified, the processed data is structured into a digital format that aligns with industry standards. The data is organised systematically, making it easy to integrate with various systems and applications.

In our Acord 126 example, the structured output could be seamlessly integrated into the insurer’s underwriting system, ensuring consistency and reducing manual data input.

Benefits of Automation

Automation revolutionises insurance operations, as seen in ACORD 126 processing using solutions like KlearStack.

Key benefits of ACORD 126 automation include:

- Enhanced Efficiency: Automation accelerates ACORD 126 processing, freeing professionals for strategic tasks.

- Error Elimination: Automated data extraction ensures precise information, reducing discrepancies.

- Format Versatility: Automation handles various formats seamlessly, catering to diverse preferences.

- Data Validation: Automation cross-references data with databases, boosting accuracy and trust.

By embracing automation, the insurance industry optimizes processes, minimizes errors, and fosters a future of streamlined operations.

Conclusion

By integrating KlearStack’s Document Automation Process into ACORD 126 processing, insurance professionals and clients embark on a journey of automation-driven efficiency. The AI-powered solution not only accelerates the processing of ACORD 126 forms but also enhances accuracy, compliance, and communication within the insurance landscape.

To explore how KlearStack’s Document Automation Process can transform your ACORD 126 processing, check out KlearStack’s free trial version and experience the platform’s capabilities and benefits, yourself!

FAQs on Acord 126

ACORD 126 is used to gather comprehensive business information for accurate risk assessment and underwriting in the Commercial General Liability Insurance Policy application process.

The most recent ACORD 125 form captures business insurance details. Always refer to ACORD’s official website for the latest version.

ACORD forms, including ACORD 126, provide essential details about liability insurance coverage. This coverage protects businesses from legal claims related to third-party injuries or property damage.

ACORD 140 is a form used for Workers’ Compensation Insurance. It captures information about employee coverage, payroll, and classifications to facilitate accurate policy underwriting.