Insurance Policy AI OCR

to Eliminate Manual

Document Processing

Save time and money with AI-powered OCR for

Insurance Policies Data Extraction

Industry Challenges

Healthcare

Automotive

Property

Life Insurance

Fixing Healthcare Document Processing

“Processing patient records and medical bills manually is a nightmare! It's slow, error-prone, and takes valuable time away from patient care.”

Klearstack's OCR supercharges healthcare claims processing. It extracts data with lightning speed and laser accuracy, reducing errors, and freeing up your team to focus on patient well-being

Designed for Insurance Policy Automation

Reclaim your time and sanity with Automated Data Extraction

Extract key information from policies in seconds, freeing your team for higher-value tasks

Reclaim your time and sanity with Automated Data Extraction

Extract key information from policies in seconds, freeing your team for higher-value tasks

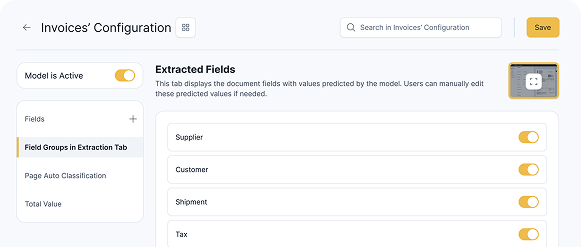

Tailor Klearstack to your unique needs with our field customizations

Tailor Klearstack to your needs. Extract the specific data points you require from each insurance policy, ensuring maximum efficiency and relevance

Break down data silos and seamlessly integrate with your existing tools

Connect Klearstack with your existing systems for automated data transfer to enhance collaboration and decision-making.

Protect your and your client’s data with the highest security compliance

Protect sensitive policyholder data with Klearstack's robust security measures. Ensure compliance and peace of mind

Scale higher without paying extra

Process any volume of documents with ease. Klearstack scales to meet your needs, ensuring consistent performance even during peak periods.

How Klearstack AI Gets Things Done

Upload the Documents

- Log in and upload documents effortlessly with drag-and-drop functionality.

- Supports multiple formats like PDF, Word, Excel, and images.

01/04

Categorize & Extract

- Select the document type (B2B or B2C) for better organization.

- KlearStack’s AI extracts data with high accuracy, continuously learning and improving from your inputs.

02/04

Review & Approve

- KlearStack's AI extracts data with high accuracy.

- Review and edit as needed, while the model continuously learns and improves from your inputs.

03/04

Access & Integrate

- KlearStack's AI extracts data with high accuracy.

- Review and edit as needed, while the model continuously learns and improves from your inputs.

04/04

What Our Customers Say

Our clients prefer secrecy!

We prioritize confidentiality, data security and protecting our client’s competitive edge.

While we don’t showcase testimonials, we’re the top choice for leading BFSI and logistics companies.

While we don’t showcase testimonials, we’re the top choice for leading BFSI and logistics companies.

J

KlearStack streamlined our invoice reconciliation and data integration, boosting efficiency and accuracy. Their exceptional support and adaptable platform are invaluable. Highly recommended for enhancing data processing.

Chief Operating Officer

Tradewinds Intl

T

We are pleased to inform you that our experience with KlearStack SaaS has been good. The solution has enabled us to streamline our document processing workflows, resulting in increased operational efficiency and reduced manual errors.

Digital Transformation Head

A Large Indian Bank

k

KlearStack has enabled us to significantly streamline our Accounts Payable Invoice processing operations. We are now able to focus our attention on more value added activities due to significant productivity improvements.

Accounts Payable Head

A Global Fortune 50 Manufacturing Enterprise

I

KlearStack made a noticeable difference in our logistics operations. Its integration was straightforward, cutting down processing times and errors. As a supply chain director, it’s become a practical asset in our quest for efficiency.

Supply Chain Director

Global Logistics Firm

M

KlearStack simplified our compliance management. Its AI technology boosted accuracy and compliance adherence, making regulatory tasks more manageable. As a compliance officer, it’s a tool I trust for staying on top of requirements.

Compaliance Officer

Global Logistics Firm

Need new document model or a custom solution?

We build it for you! Let’s talk,

Case Studies

Decreased Loan Processing Time by 300% for a Bank

Improvement in Team Productivity

80%

Times Faster Loan Processing

300%

Straight Through Processing

85%

Transforming Cut Flower Supply Chain Operations

Cost Reduction

80%

Operational Efficiency

500%

Accuracy

99%

One Platform, Comprehensive

Document Intelligence

Document Intelligence

KlearStack’s Key Features

01

Pre-trained Document

Models

Models

02

Auto-Classification of

Documents

Documents

03

Auto-Classification of

Pages

Pages

04

Document & Page

Auto-splitting

Auto-splitting

05

Custom Model

Creation

Creation

06

Data

Extraction

Extraction

07

Easy-to-use APIs

08

Approval Workflows

09

Human in the Loop

10

Out-of-the-box Integrations

11

Data Validation

12

Data Reconciliation

13

Real-time Data Insights

14

Template-free Data Extraction

15

Day Zero Accuracy